Given the recent market turmoil and some time since a portfolio update, I thought I'd share the latest holdings, trades and outlook on the market:

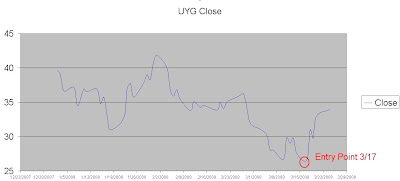

The most notable recent trades were the plunge into the financials last Monday with the leveraged 2X Financial Sector ETF UYG. I can't take credit for stellar performance this year, but in this case, I called the bottom spot on (here). On Monday 3/17, I recorded the following transaction for a 1 week 35% return:

3/17, Bought 100 UYG @ 26.069

Today, Sold 33 UYG @ 35.0206

I'm still holding the remainder with the thought that the Financials are undergoing a sustained recovery, but this is a rather bold statement, so I took 1/3 off the top.

Elsewhere in the portfolio, I sold the gold ETF GLD and bought the 2X leveraged ETF DGP. I believe gold's going to hit 1200 before it hits 800 per ounce. The dollar has staged some temporary strength, but I don't think it's going much higher given further cuts and a long way to go to true stability in the economy.

On a bit of a whim, I bought Sirius Satellite when I caught wind of the merger announcement with XM. I'm kicking myself for this one. It's been a year that this routine, logical merger should have been approved and the action was awaiting finalization. I should have bought in months ago, but following a random conversation in the office about the news, I bought in at $3.19 per share and in after hours, it's at $3.26 for a nominal gain as of now. I envision as the relief sets in and terms and conditions are fully recognized (along with requisite regulatory approval), the shares move up from here, not down.

Below is a full snapshot of the trading portfolio:

BIDU

CHL

DGP

FMCN

GOOG

KTII

SIRI

SU

TKC

UYG

VIP

To highlight a few notables...

- Baidu.com was up 15% today. I think BIDU has been overly punished during this downturn in Chinese stocks, as it is the leader in an increbible market with real earnings.

- I'd sold off about half of the holdings in FMCN and CHL, both Chinese stocks, after runups of over 150% each. Unfortunately, the remaining half of each position has declined significantly this year. I'm holding both through the Olympics this year in anticipation of strong demand for both advertising with FMCN and continued growth in cellular service with CHL.

- A stock I've been especially pleased with is the little-known K-Tron (KTII). It has held up quite well in this downturn and is virtually recession-proof. Full background here.

- I also expect to see the other emerging market telecom stocks VIP (Russia) and TKC (Turkey).

No comments:

Post a Comment